Estate disputes are complex matters. Often, both the claimant and those responsible for administrating estates embark on the process for the first time. Consequently, clients will fail to provide complete or accurate instructions, resulting in disappointing initial meetings.

Settify guides clients gently through the complexity by asking them questions about their circumstances. Settify streamlines the process to enhance understanding and reduce back-and-forth between you and your clients.

Set the stage for a strong client relationship.

Guide Clients Through Complexity

Clients receive personalised information relating to their rights and the process ahead. This includes information about their eligibility and the time frames in which they will need to take action.

Streamlined Chronology

Developing a chronology of the salient facts can be time-consuming for both clients and lawyers. Settify builds a chronology automatically, establishing key events in a neat and well-ordered series. This better prepares lawyers for their initial client consult and forms a valuable starting point.

Reduce Risk

Settify helps firms reduce risk by identifying any relevant limitation periods. The system advises clients of limitations and automatically reminds law firms of upcoming dates via automated calendar appointments.

Designed for Estate Disputes

Settify is a proven way to ‘take clients off the market’ by providing an immediate and accessible way for them to get started online.

Client Education

Clients receive personalised information about the process ahead of them.

Document Gathering

Clients are prompted to upload copies of Wills, Death Certificates, and statements.

Simple Revisions

Clients can review their answers before submitting their information, reducing errors and ensuring accurate instructions.

Enduring Record

The Settify brief is a lasting and helpful record of initial instructions that can be referenced as the matter progresses.

Gets clients thinking

“Settify introduces areas the process to clients and gets them thinking about questions that may not have otherwise occurred to them.”

Coulter Legal

Understand your client before you meet

“The lawyer already knows about their client’s matter and has enough information to discuss options and strategies at the first consultation.”

Brazel Moore Lawyers

Using technology to embrace the law

“Settify provides another avenue for clients to efficiently provide information to their lawyers to deliver the best legal service in a timely manner.”

Aitken Partners

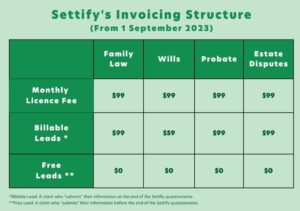

Pricing

Our streamlined, automated intake system is the simple way to take your practice to the next level.

Every law firm is unique, so we offer pricing tailored to your size and needs.

Settify does the heavy lifting regarding client onboarding, allowing you to focus on what you do best – providing your clients with excellent advice.

Streamline your workflow and have brilliant first meetings every time with Settify.

Simple to integrate, meaningful results.

Our streamlined process is easy to tailor to your firm’s needs.

1. Integrate

We embed Settify into your website using your firm’s branding, logo and colours.

2. Invite

Prospective clients can kick off the process on your website or via a link sent in a welcome email.

3. Ask

Settify invites prospective clients to answer simple questions about their situation.

4. Learn

Clients receive personalised information about the legal process, their options and how your firm can help.

5. Instruct

The client then provides detailed information in their own time.

6. Extract

Settify generates a summary of the client’s instructions for your lawyers, including an editable table of assets and liabilities, with formulae to help you make essential calculations.

Settify also has products for the areas of Family Law, Wills and Probate.

FAQs

How do I integrate Settify into my website?

We embed our technology on your webpage. We use your firms’ branding, logo and colours so the experience is seamless for your future clients. Our team liaise with your website administrator to add the Settify button to your website. We then provide all the hosting, troubleshooting and technical support for the Settify system.

How are conflicts handled?

An email is sent to your reception when a client completes Settify from your website, including the client and spouse’s name, address, and date of birth. Using these details, you can run your conflict check. If conflicted, we cut off access to the rest of the client’s information, so no one at your firm will ever have seen it. Otherwise, click ‘No Conflict’ to receive the full brief.

How does the billing process work?

Having comprehensive information about a client’s situation is vital to providing timely and meaningful advice. Our partner firms tell us that Settify allows them to engage with clients 24/7; their clients love providing valuable information at a time and place that suits them.

Lawyers save up to three hours per matter by receiving a detailed brief, balance sheet, asset and liabilities schedule and other pertinent client information from the Settify platform. This information minimises unbillable time and gives you a significant advantage when developing advice for the client.

Our Fair Billing Pricing Structure explains pricing across all platforms.

Can I disburse the Settify fee?

Yes, many firms choose to pass the fee on to clients. Clients think that’s fair, as it would cost them far more to provide their information in person during the first conference. We can configure your system to provide the appropriate disbursement notice.

How does Settify secure client information?

We take data security very seriously. To ensure that your client’s confidential information remains confidential, Settify takes the following steps:

- Client information is stored onshore with Amazon Web Services (military and bank-grade security).

- All data is encrypted at rest (sitting in the cloud) and in transit (when moved from the cloud to the solicitor).

- Regular internal and external security penetration testing of the Settify system.

- Automatic information deletion.

- After 60 days of inactivity, client information is frozen and cannot be accessed unless the client or lawyer completes specific requirements.

- After 2 years, all identifying client information is securely destroyed.